Ever wonder how France’s stock market is doing? You can get to know the overall health of the French economy by following CAC40 FintechZoom. The CAC 40 index tracks the 40 largest companies listed on the Euronext Paris exchange from different sectors, such as energy, finance, consumer goods, and more. Every three months, the Index Steering Committee reviews the list to make sure it includes the top performers.

Major findings of the CAC40 index:

- The CAC 40 features heavyweight companies and well-established names like LVMH (luxury goods) and L’Oréal (cosmetics). These companies tend to be more stable, which can be good for investors seeking lower risk.

- The index offers investors opportunities for both short-term trading and long-term investment strategies. Investors gain index exposure through index-tracking funds, exchange-traded funds (ETFs), futures contracts, options, or by directly investing in constituent stocks.

- Comparing the returns of a portfolio or fund to the CAC 40 provides insights into its relative performance against the broader market.

- Changes in the CAC 40 index reflect shifts in investor sentiment, market expectations, and economic conditions. Bullish trends typically indicate optimism and confidence in the economy, while bearish trends may signal concerns about economic growth, corporate earnings, or external risks.

How is it Weighted?

CAC 40 is a capitalization-weighted index. This means the companies with the highest market value have a bigger influence on the index’s overall performance.

Companies with a higher market cap, like LVMH or Total Energies, have a bigger influence on the CAC 40’s overall performance.

15% Capping

It follows a 15% capping rule that limits the weighting of a single company to 15% of the total index. This rule prevents any one company from having an outsized influence on the overall performance of the index, making sure that the index remains diversified and representative of the broader market.

If a company’s market capitalization exceeds the 15% limit, its weighting in the index is adjusted downward to comply with the rule. This adjustment can be done by reducing the number of shares of the company included in the index calculation or applying a multiplier to the company’s stock price.

There are a few things to keep in mind about the CAC 40 index:

- The CAC 40 gets shuffled around every quarter to ensure it reflects the current state of the French market. The biggest companies today may not be the biggest ones tomorrow.

- While the CAC 40 offers stability, it might not be the best option for investors seeking high growth potential. The index has a smaller focus on fast-growing sectors like technology compared to some other broader indexes.

Investors and financial analysts use the CAC40 FintechZoom to evaluate the performance of investment portfolios, mutual funds, and investment strategies.

Historical Performance of CAC40 FintechZoom

The CAC 40 has a long and interesting history, with its ups and downs reflecting the performance of the French economy and global events. It is one among the main national indices of the pan-European stock exchange group Euronext, along with the AEX, BEL 20, PSI 20, and OBX.

The CAC 40 was introduced on December 31, 1987, with a base value of 1,000. During the late 1990s and early 2000s, the index experienced a significant bull run fueled by the dot-com bubble. It reached an all-time high of 6,922.33 on September 4, 2000.

The index then experienced a sharp decline during the dot-com bubble burst and the attacks on September 11, 2001. It bottomed out at 2,403.04 on March 12, 2003. After the recovery from the dot-com bust, the index experienced another major downturn during the global financial crisis of 2007-2008. It fell to a low of 2,519.59 on March 9, 2009.

Following the financial crisis, the CAC 40 experienced a steady recovery and reached new highs, surpassing the pre-crisis levels by 2017. In 2020, the index was heavily impacted by the COVID-19 pandemic, plummeting to a low of 3,632.06 on March 16, 2020. Still, it subsequently recovered as economies reopened and fiscal and monetary stimulus measures were implemented.

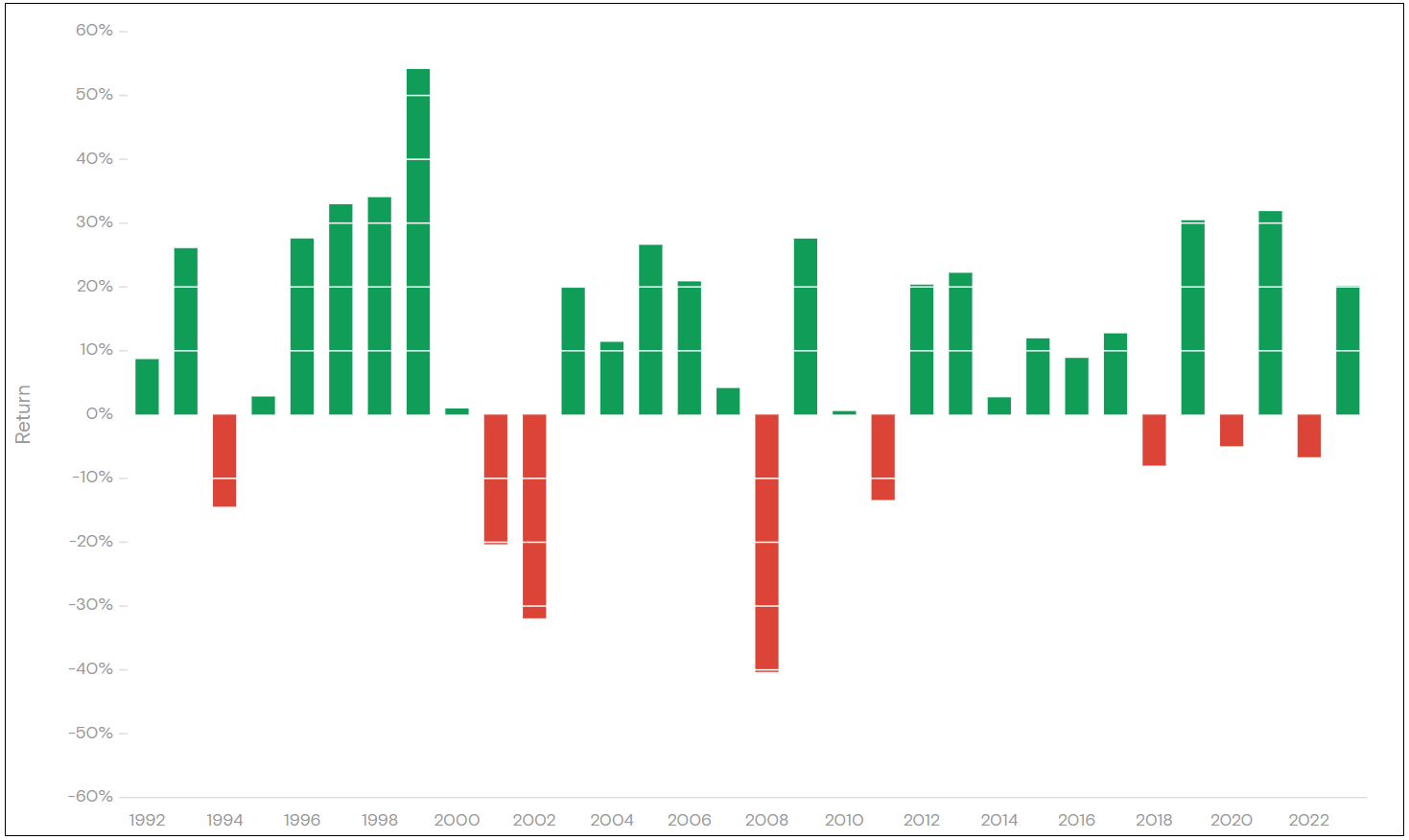

Annual Returns

The chart below shows the average returns of the CAC 40 index over the last periods.

In recent years, the CAC 40 has been influenced by factors like global economic conditions, geopolitical tensions, and central bank policies.

CAC40 FintechZoom equips you with the tools and knowledge to stay ahead of trends, analyze data, and make informed investment decisions in the French Stock Market.

Composition of the CAC 40 Index

LVMH, the world’s leading luxury goods conglomerate, is a key component of the index, along with other renowned consumer brands like L’Oréal (cosmetics), Pernod Ricard (wines and spirits), and Kering (luxury fashion). The financial sector is well-represented by banking giants such as BNP Paribas, Société Générale, and insurance powerhouse AXA. Energy major TotalEnergies and pharmaceutical company Sanofi are also pivotal components.

The industrials segment includes aerospace leader Airbus, electrical equipment manufacturer Schneider Electric, and construction materials company Saint-Gobain. Other notable names are Orange (telecommunications), ArcelorMittal (steel production), Dassault Systèmes (3D software), and Unibail-Rodamco-Westfield (commercial real estate). These companies are among the largest and most influential in their respective industries, not just in France but globally, reflecting the economic significance and diversity of the French equity market.

The current top 10 companies in the CAC 40 Index by market capitalization are:

| Rank | Company Name | Market Cap (Est.) |

| 1 | LVMH Moët Hennessy Louis Vuitton SE | €400 Billion+ |

| 2 | Hermès International SCA | €300 Billion+ |

| 3 | L’Oréal SA | €250 Billion+ |

| 4 | TotalEnergies SE | €200 Billion+ |

| 5 | Airbus SE | €150 Billion+ |

| 6 | Schneider Electric SE | €100 Billion+ |

| 7 | Stellantis NV | €90 Billion+ |

| 8 | Sanofi SA | €80 Billion+ |

| 9 | Dassault Systèmes SE | €70 Billion+ |

| 10 | Vinci SA | €60 Billion+ |

The list isn’t static. As discussed above, it is updated quarterly after review by the Index Steering Committee. If a new company has grown bigger and deserves a spot, or an existing member’s performance has slipped, the committee can shuffle the deck to keep the CAC 40 current. Therefore, understanding the complexities of the index through CAC40 FintechZoom while investing is crucial.

Industry Breakdown of the CAC 40 Index

The index components represent a diverse range of industries, reflecting the breadth of the French economy. In terms of industry breakdown:

- The consumer sector consists of companies involved in luxury goods, automobiles, and beverage production. Meanwhile, the consumer staples sector comprises firms operating in the cosmetics, food, and beverage industries.

- The largest component of the CAC 40 is the financial sector, encompassing major banks, insurance companies, and other financial services providers that play a crucial role in the French economy.

- The industrial sector also has a substantial presence, including companies involved in aerospace, electrical equipment, construction materials, and tire manufacturing, among others.

- Other notable sectors represented in the CAC 40 include energy, healthcare, information technology, materials, real estate, telecommunication services, and utilities.

This diversified industry representation ensures that the CAC40 FintechZoom provides a comprehensive view of the French equity market, capturing the performance of various sectors that drive the country’s economic growth and development. Here is a table presenting the overview of the different industries represented in the CAC 40 index and their respective weightings within each industry.

| Industry | Weight |

| Consumer Discretionary | 16.5% |

| Consumer Staples | 14.8% |

| Energy | 7.3% |

| Financials | 17.1% |

| Health Care | 9.1% |

| Industrials | 11.9% |

| Information Technology | 4.7% |

| Materials | 2.9% |

| Real Estate | 1.2% |

| Telecommunication Services | 4.3% |

| Utilities | 3.8% |

The table highlights the dominance of consumer-related sectors, financials, and industrials while also showing the smaller allocations to sectors like information technology, materials, and real estate.

Criteria for Selecting Companies in the Index

The CAC 40 index is a capitalization-weighted index tracking the performance of the 40 largest companies listed on the Euronext Paris stock exchange. The selection of companies to be included in the index is based on specific criteria set by the Conseil Scientifique, an independent steering committee responsible for overseeing the index composition.

Market capitalization: Companies are ranked on their free-float market capitalization. It is calculated by multiplying the total number of outstanding shares by the share price and considering only the shares available for trading. The top 40 companies with the highest market capitalization are included in the index.

Free-float factor: The free-float factor refers to the percentage of a company’s shares that are readily available for trading on the stock exchange. Companies with a higher free-float factor are preferred, as it ensures better liquidity and tradability of the stock.

Sector representation: The Conseil Scientifique aims to ensure that the CAC 40 index is representative of the overall French economy. As such, the index composition considers sector diversification to provide a balanced representation of different industries.

Liquidity: A crucial factor in the selection process. Companies with higher trading volumes and tighter bid-ask spreads are favored, as they are considered more liquid and easier to trade.

Listing history: Companies must have been listed on the Euronext Paris exchange for a minimum period, typically at least one year, to be eligible for inclusion in the CAC 40 index.

Domestic or foreign companies: Both domestic French companies and foreign companies listed on the Euronext Paris exchange qualify for inclusion in the index.

Corporate governance: Companies with strong corporate governance practices, such as transparency, accountability, and adherence to ethical standards, may be favored for inclusion in the index.

The Conseil Scientifique reviews the index composition quarterly and makes necessary adjustments to ensure that the CAC 40 remains representative of the French equity market and reflects any changes in the underlying companies’ market capitalization or other selection criteria.

CAC40 FintechZoom Recent Trends

The CAC 40, France’s flagship stock index, has experienced significant volatility in recent months. CAC 40 FintechZoom shows a compound annual growth rate of 7.95% and a standard deviation of 18.07% from February 1991 to February 2024.

- The latest stock price for the CAC 40 Index is 8,153.23, with a delta of +23.18 (0.29%).

FintechZoom’s team of expert analysts has been closely monitoring developments to provide investors with valuable insights into the latest trends.

- One major trend they’ve identified is the outperformance of defense sectors like healthcare and consumer staples. As concerns over economic growth persist, investors have flocked to companies like Sanofi and L’Oreal that offer relative stability.

- In contrast, cyclical sectors tied to the economy’s strength, such as financials and industrials, have lagged. The data shows fears of recession have weighed down the banking sector, while industrial giants like Airbus have suffered from supply chain disruptions.

- However, the analysts note pockets of resilience. The luxury goods segment represented by LVMH and Hermes has demonstrated pricing power fueled by robust demand from affluent customers. Energy has also been a bright spot as elevated oil prices buoyed TotalEnergies.

Through FintechZoom’s cutting-edge platform, investors can access these timely insights, analytics, and forecasts for the CAC 40. The fintech’s powerful tools aim to empower investors to navigate uncertainty with data-driven decision-making.

FintechZoom’s Holistic Approach to CAC 40 Analysis

FintechZoom provides investors with an unparalleled suite of data, analytics, and research on the CAC 40 index and its components. Their coverage leaves no stone unturned when it comes to understanding and analyzing the French market.

At the index level, FintechZoom offers real-time pricing data, historical charts, trading signals, and index composition details. Investors can access in-depth reports on index trends, sector rotations, factor analysis, and potential future catalysts.

However, CAC40 FintechZoom offerings go far beyond just the index level. Their coverage drills down to provide a granular analysis of each of the 40 constituent companies. This includes:

- Company financials modeling with automated GAAP disclosures

- Natural language processing of earnings call transcripts and company filings

- Quantitative models ranking companies on quality, growth, and valuation metrics

- Alternative data analysis integrating ESG, supply chain, social media, and other signals

- Analyst research reports with trade recommendations and price targets

With FintechZoom, investors have all the critical CAC 40 data, tools, and insights they need in one centralized location to make timely and informed investment decisions in the French market.

World’s Market Indexes vs. CAC 40

As a leading benchmark for the French equity market, the CAC 40 index holds significant importance not just domestically but also on the global stage. To better contextualize its standing, it’s instructive to compare the CAC 40 with other major stock market indices from around the world.

The following table provides a comprehensive overview, juxtaposing the CAC 40 against influential benchmarks like the S&P 500, FTSE 100, Nikkei 225, DAX, Hang Seng, and Bovespa. This comparison sheds light on the CAC 40’s composition, market capitalization, sector weightings, and prominent constituent companies relative to its global peers:

| Index | Country | Components | Market Cap ($ Billion)* | Sector Weightings | Key Companies |

| CAC 40 | France | 40 largest French companies | $2.96 trillion | Consumer Discretionary (16.5%), Financials (17.1%), Industrials (11.9%) | LVMH, TotalEnergies, L’Oréal, BNP Paribas, Sanofi |

| S&P 500 | USA | 500 large-cap US companies | $37.07 trillion | Information Technology (26.6%), Health Care (14.6%), Financials (11.2%) | Apple, Microsoft, Amazon, Alphabet, Tesla |

| FTSE 100 | UK | London Stock Exchange

with the largest 100 companies |

$2.84 trillion | Financials (17.8%), Consumer Staples (16.4%), Energy (11.5%) | Shell, AstraZeneca, HSBC, Unilever, BP |

| Nikkei 225 | Japan | Largest 225 companies on the Tokyo Stock Exchange | $5.5 trillion | Industrials (23.1%), Consumer Discretionary (20.2%), Information Technology (12.8%) | Toyota, Sony, Nintendo, SoftBank, Keyence |

| DAX | Germany | 40 major German companies | $2.17 trillion | Industrials (17.5%), Health Care (15.1%), Consumer Discretionary (13.8%) | Siemens, SAP, Volkswagen, Allianz, Daimler |

| Hang Seng | Hong Kong | Hong Kong Stock Exchange

: 50 largest companies on the |

$3.86 trillion | Financials (36.3%), Consumer Discretionary (13.6%), Information Technology (11.4%) | AIA Group, HSBC, Tencent, Alibaba, Meituan |

| Bovespa | Brazil | Companies listed on the Brazil Stock Exchange | $0.94 trillion | Financials (24.9%), Materials (16.1%), Consumer Staples (14.6%) | Vale, Petrobras, Itaú Unibanco, Ambev, Bradesco |

From this comparative analysis, several key insights emerge. The CAC 40’s total market capitalization of $2.96 trillion places it among the upper echelons of global equity indices, albeit dwarfed by the sheer size of the US-based S&P 500. Its sector makeup, with a tilt towards consumer discretionary, financials, and industrials, reflects the strengths of the French economy and the multinational corporations that call it home.

Future Prospect for CAC 40

The CAC 40 (FR40) has fallen 7% so far in 2024. This decline coincides with a slowdown in global economic growth and rising inflation across many regions, including Europe. The ongoing conflict in Ukraine and the resulting energy crisis have heightened concerns about a potential recession in Europe.

Despite these challenges, the index has managed to outperform some of its European counterparts and even major US indexes like the S&P 500 (US500) and the Nasdaq 100 (US100) so far this year.

Studies suggest that the index is expected to climb to 11,395 a year from now, implying a 71.9% gain within that period. The CAC40 FintechZoom forecast for 2023 is 11,514, and for 2025, it is 26,107.

Global economic changes, trends, and national events, such as French presidential elections, wars, and natural disasters, can also have an incredible impact on the CAC 40. French social and geopolitical issues, such as changes in government policies or economic indicators, can also influence the index. In summary, the CAC 40 index can be influenced by various factors, including changes in the supply and demand of specific goods and services, constituent performance, global economic changes, trends, and national events, and French social and geopolitical issues.

Note: Investors should always conduct their own due diligence before making any investment decision.

By constantly pushing the boundaries of what’s possible, FintechZoom aims to empower investors with the insights they need to navigate the complexities of the French equity market with confidence.

Conclusion

Understanding and investing in the index requires insight into trends, analysis, and strategies, all of which CAC40 FintechZoom provides. It remains at the forefront, offering innovative tools and insights as the CAC 40 evolves. With its comprehensive approach and commitment to innovation, FintechZoom is a trusted resource for navigating the complexities of the French stock market, ensuring investors stay ahead in their investment endeavors.

FAQ’s

Is it necessary to have a French broker to invest in the CAC 40?

To invest in the CAC 40 index, it is not necessary to have a French broker. Investors can access the CAC 40 index through various financial products like ETFs, index futures, options, and spread trading, which are available on international trading platforms. Additionally, Lyxor CAC 40 ETFs are traded on exchanges outside of France, providing global access to this index.

Can I directly invest in the CAC 40?

No, the CAC 40 itself is not an investable asset. However, you can invest in funds that track the CAC 40 or trade futures contracts or CFDs (contracts for difference) based on the index.

Who are the shareholders of the CAC 40?

It is quite interesting that over 45% of the CAC 40, France’s main stock market index, is owned by investors outside France. The highest share of CAC 40 lies with Europe, surpassing others, including German, Japanese, American, and British investors who are big fans of French companies.

How do changes in interest rates affect the CAC 40 index?

hen interest rates rise, borrowing costs increase, which can lead to decreased consumer spending and reduced corporate profits. This can negatively impact the stock prices of companies within the CAC 40 index, causing the index to decline. On the other hand, when interest rates fall, borrowing costs decrease, which can lead to increased consumer spending and higher corporate profits.