In today’s rapidly evolving financial landscape, staying ahead of the curve is more crucial than ever. Enter Fintechzoom SP500, your ultimate companion for navigating the complexities of the Standard & Poor’s 500 Index with ease and precision. This platform revolutionizes the way savvy investors make decisions, offering real-time insights and a user-friendly interface that transforms financial analysis.

Thematic exchange-traded funds (ETFs) have emerged as a popular investment vehicle for investors seeking targeted exposure to specific sectors or themes. These ETFs track a basket of securities that are related to a particular theme, such as clean energy, healthcare, or, as in this case, Fintech. The S&P 500 ETF is one such example, offering investors a convenient and efficient way to invest in the US-listed companies shaping the future of finance.

Whether you’re a seasoned investor or just starting out, Fintechzoom SP 500 is the tool you need to stay informed and ahead in the game.

Key Takeaways

- The S&P 500 is a critical benchmark for U.S. economic prosperity, featuring a diverse range of large-cap U.S. equities across multiple sectors, reflecting the overall health of the U.S. economy.

- The total returns of the S&P 500 index include both price returns and dividends, with dividends playing a significant role in overall investment returns.

- Inflation-adjusted, the historical average annual return of the S&P 500 is around 6.37%, highlighting the impact of inflation on investment returns.

- Leveraging Fintechzoom for S&P 500 analysis empowers investors with real-time data and comprehensive market insights, aiding in quicker, more informed decision-making amidst the market’s complexities.

Fintechzoom SP500

The S&P 500, formally known as the Standard & Poor’s 500 Index, is a market capitalization-weighted index that tracks the performance of 500 leading publicly traded companies listed on stock exchanges in the United States. It’s often considered the best single gauge of large-cap U.S. equities.

When navigating the complexities of the financial markets, understanding the S&P 500 becomes essential for every investor, whether you’re just starting out or you’re a seasoned trader.

One of the key attributes of the S&P 500 is its diversity. Covering multiple sectors, from technology to healthcare, it provides a broad snapshot of the U.S. economy. This diversity ensures that investors have exposure to different sectors, helping to mitigate risks associated with market volatility. Moreover, the S&P 500’s performance is closely watched around the world as an indicator of the health of the U.S. economy and, by extension, global financial markets.

Investing in the S&P 500 allows you to take advantage of the growth potential of these large companies. With the advent of various financial products, such as mutual funds and exchange-traded funds (ETFs) that track the performance of the S&P 500, investors have the opportunity to gain exposure to the U.S. equities market with relative ease.

Historical Performance

Historically, the S&P 500 has been a benchmark for U.S. economic prosperity. For instance, following the financial crisis in 2008, the S&P 500 experienced significant volatility, with a major drop of over 500 points on September 15, 2008, after the bankruptcy of Lehman Brothers. Despite such fluctuations, the index has shown remarkable resilience over time. After hitting a 12-year low in March 2009, it has steadily climbed, reflecting the recovery and growth of the U.S. economy.

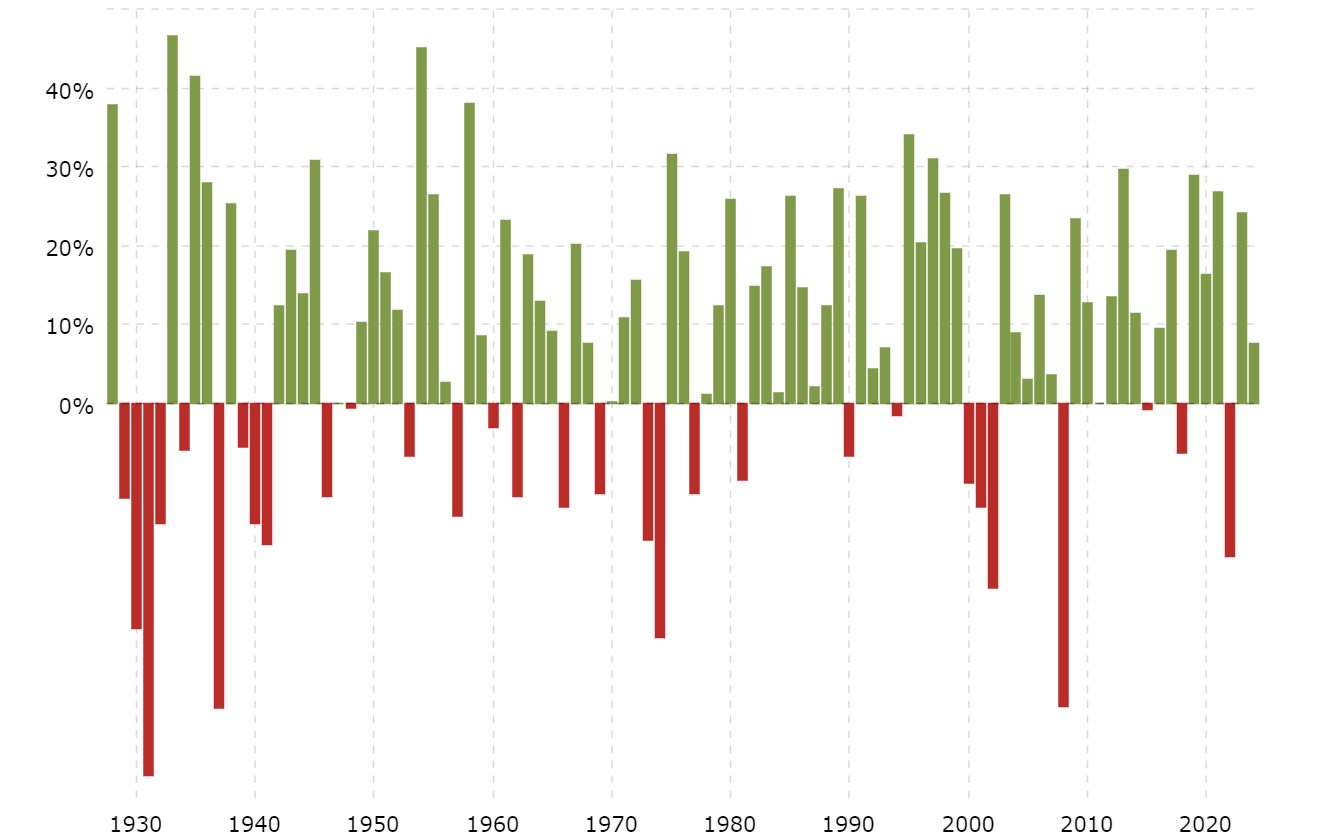

Looking back, since its inception in 1928, the S&P 500 has had an average annualized return of 9.90% through December 31, 2023, and since adopting 500 stocks in 1957, the average annualized return has been 10.26%

The incorporation of real-time data and analytics platforms like Fintechzoom SP500 into your investment strategy can be a game-changer. These platforms provide valuable insights and up-to-the-minute information, enabling you to make informed decisions swiftly. Remember, staying informed and leveraging the right tools are pivotal in navigating the S&P 500 successfully.

Composition of the FintechZoom SP 500

When you’re diving into the world of investing, understanding the intricacies of indices like the FintechZoom S&P 500 is invaluable. This section will break down the composition of the S&P 500, guiding you through its top companies, the industry breakdown, and the selection criteria for companies included in the index.

Top Companies Currently Included in the Index

The FintechZoom SP 500 boasts some of the largest and most influential companies in the U.S. economy. Tech giants such as Apple, Microsoft, and Amazon are significant players, reflecting the tech industry’s substantial impact on global markets. Additionally, financial powerhouses like JPMorgan Chase and healthcare leaders including Johnson & Johnson play crucial roles. These companies are not just heavyweights in their respective fields but also indicators of the index’s overall health and direction.

Industry Breakdown of the Index Components

The FintechZoom SP 500 is a tapestry of diverse industries, reflecting the breadth of the U.S. economy. It is categorized into 11 sectors using the Global Industry Classification Standard (GICS). Here’s a simplified breakdown:

- Technology: This sector includes companies involved in software, hardware, and tech services.

- Healthcare: Encompassing pharmaceuticals, biotechnology, and healthcare equipment.

- Financials: Covers a broad range of financial services, including banks, investment funds, and insurance companies.

- Consumer Discretionary: This sector includes companies related to retail, automotive, and consumer services.

The index is designed to provide a comprehensive overview of the market by rightfully representing sectors based on their market cap and influence on the economy.

The current breakdown of the S&P 500 as of March 3, 2024, is as follows:

| Sector | Weight (%) |

| Information Technology | 29.80% |

| Health Care | 12.50% |

| Financials | 13.00% |

| Consumer Discretionary | 10.60% |

| Communication Services | 8.90% |

| Industrials | 8.70% |

| Consumer Staples | 6.60% |

| Energy | 3.80% |

| Utilities | 3.30% |

| Real Estate | 1.90% |

| Materials | 1.00% |

Criteria for Selecting Companies in the Index

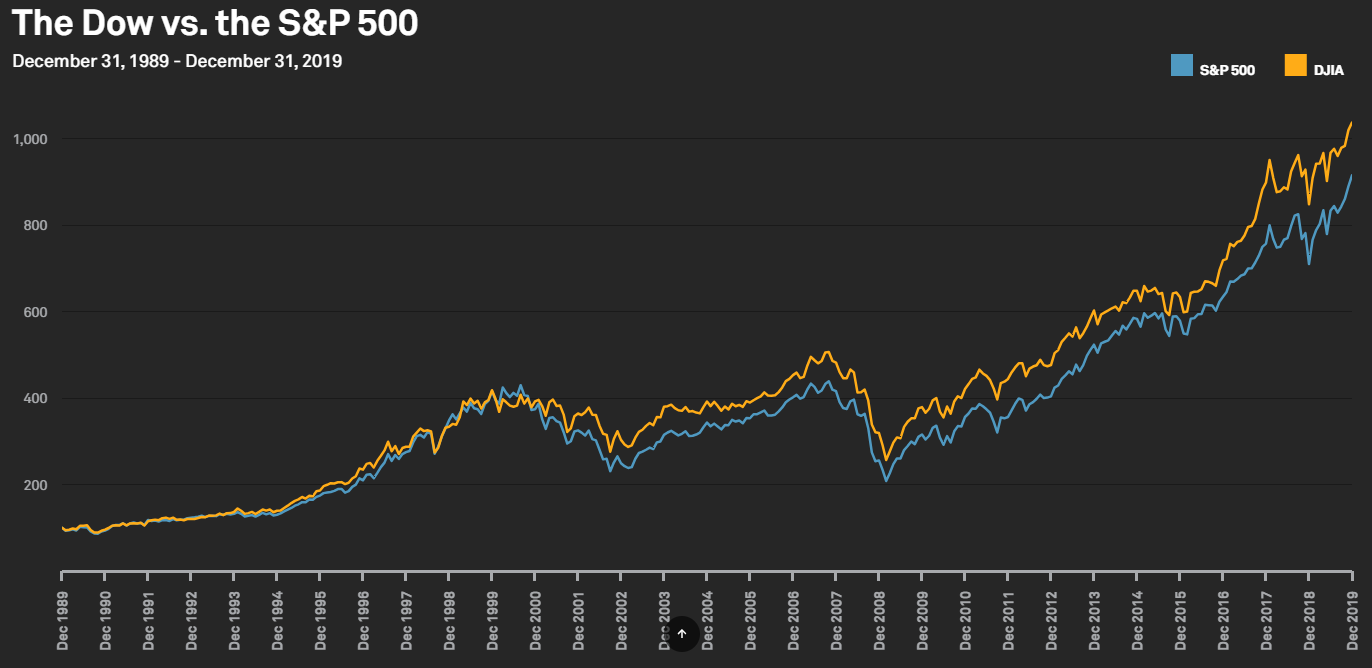

Unlike price-weighted indexes like the Dow Jones Industrial Average, which simply add up the share prices of its constituent companies, the S&P 500 utilizes a market capitalization-weighted approach. This means the influence of each company on the overall index value is proportional to its total market size.

Companies listed in the S&P 500 are selected based on several rigorous criteria:

- Market Capitalization: To be considered, a company must have a market cap of $8.2 billion or more. For each company in the S&P 500, the market capitalization is calculated by multiplying the current share price by the number of outstanding shares. This essentially reflects the total market value of all the company’s publicly traded shares. Companies must have four consecutive quarters of positive earnings.

- Public Float: At least 50% of the company’s shares must be available to the public. The S&P 500 employs a “float-adjusted” market capitalization, which considers only the shares readily available for public trading. This excludes restricted shares held by major shareholders or institutions, providing a more accurate representation of the investable portion of the company.

- Index Value Calculation: The S&P 500 index value is calculated by summing the float-adjusted market capitalizations of all 500 companies. This single figure encapsulates the overall market value of the leading publicly traded companies in the U.S.

- Rebalancing: To maintain the index’s accuracy and reflect changes in the underlying companies, the S&P 500 undergoes periodic rebalancing. This process might involve adding or removing companies based on their market capitalization and adjusting the weightings of existing companies if their market size changes significantly.

These criteria ensure that the S&P 500 remains a reliable barometer for investors who seek to gauge the market’s health through a diversified and dynamic lens. By tracking such a meticulously curated index, you’re getting insights into the pulse of the U.S. economy, making the FintechZoom SP 500 an indispensable tool in your investment strategy.

How FintechZoom Plays a Role in S&P 500

In the rapidly evolving world of finance, staying ahead means leveraging the best tools and data at your disposal. FintechZoom has emerged as a key player in providing investors with critical insights and analytics for the S&P 500. Here’s how it’s making a difference.

Data Analysis

With FintechZoom, you’re not just looking at numbers; you’re engaging with data that talks back. The platform’s robust analytics tools delve deep into the S&P 500, offering a detailed breakdown of performance metrics across various sectors and companies. This isn’t about skimming the surface. the platform enables you to:

- Perform historical performance reviews, spotting patterns that might not be evident at first glance.

- Harness real-time updates, which are crucial for timely decision-making in a market that never sleeps.

- Access diverse visualization tools, transforming complex datasets into intuitive, easy-to-understand graphics.

This comprehensive approach to data analysis doesn’t just inform you—it empowers you to make predictions and strategies with a higher confidence level.

Market Trends

Understanding current market trends is vital for any investor, and FintechZoom stands out in this regard. By providing real-time data on the S&P 500 index, the platform ensures you’re always in the loop with the latest developments. But it goes further by:

- Highlighting emerging sectors and technologies that are poised for growth, allowing you to diversify your portfolio wisely.

- Offering insights into macroeconomic indicators that influence market movements, ensuring your investment decisions are well-informed and timely.

- Analyzing price fluctuations and trading volumes, which can offer clues about potential future movements.

FintechZoom’s analysis of market trends isn’t just about reporting what’s happening now—it’s about forecasting what could happen next, giving you a strategic advantage.

By integrating detailed data analysis with cutting-edge market trend insights, the FintechZoom platform equips you with everything you need to navigate the complexities of the S&P 500. Whether you’re a day trader looking to capitalize on short-term movements or a long-term investor focused on substantial growth, the platform’s comprehensive coverage ensures you’re well-prepared to make your next move.

Fintechzoom’s Comprehensive S&P 500 Coverage

With Fintechzoom SP 500, you’re not just looking at numbers; you’re gaining a deep understanding of its movements. When diving into the world of investments, especially within the S&P 500, you’ll find that Fintechzoom’s comprehensive coverage is an indispensable tool at your fingertips. The platform’s real-time insights and analytics offer a broad spectrum of data ranging from historical performance reviews to cutting-edge visualization tools, ensuring that you’re always one step ahead.

At the heart of Fintechzoom’s functionality is its ability to distill complex market data into user-friendly interfaces. This means that whether you’re a seasoned investor or just starting out, you’ll have access to precise, up-to-the-minute data that’s easy to understand and act upon. The platform shines in its provision of real-time updates, which are crucial for making timely investment decisions.

- Real-Time Updates: Stay updated with the latest market movements.

- Historical Data Analysis: Gain insights from past market trends to predict future movements.

- Visualization Tools: Make complex data digestible with easy-to-understand graphs and charts.

Furthermore, the tool’s ability to identify emerging sectors and provide insights into macroeconomic indicators places it a notch above the rest.

Whether it’s spotting trends in price fluctuations or analyzing trading volumes, Fintechzoom equips you with the knowledge to navigate the complexities of the S&P 500 with confidence.

Dow Jones vs. S&P 500 vs. Nasdaq: Understanding the Key Differences

The Dow Jones Industrial Average (DJIA), S&P 500, and Nasdaq Composite are all prominent stock market indexes, but they differ significantly in their composition, weighting methods, and overall market representation.

Let’s understand the key features of each index for investors seeking to navigate the financial landscape.

| Feature | Dow Jones Industrial Average (DJIA) | S&P 500 |

Nasdaq Composite

|

| Number of Companies | 30 | 500 | Over 3,000 |

| Composition | Large, blue-chip companies across various sectors | Leading publicly traded companies in the U.S. across various sectors |

All companies listed on the Nasdaq stock exchange, primarily technology, biotech, and consumer electronics

|

| Weighting Method | Price-weighted | Market capitalization-weighted |

Market capitalization-weighted

|

| Market Representation | Narrow, focuses on established large-cap companies | Broader, comprehensive picture of the U.S. large-cap market |

Most extensive, strong focus on technology and growth-oriented sectors

|

| Suitable for Investors Seeking | Exposure to established, large-cap companies and a traditional market view | Balanced representation of the U.S. large-cap market |

Exposure to the technology sector and potential for high growth

|

FintechZoom isn’t just about tracking the S&P 500. It’s your gateway to the whole financial world! Whether you’re interested in the fast-paced tech of the Nasdaq or the Dow Jones FintechZoom insights, it captures all the important market info and makes it easy to understand. With fancy technology, they turn raw market data into clear and helpful insights that can guide your financial decisions.

Future Outlook for the FintechZoom SP500

As you dig into the future of investing with FintechZoom’s S&P 500 analysis, understanding the evolving landscape of this index is crucial. The real-time data access and comprehensive analytics you’ve come to expect from the platform provide an unparalleled view into what the future holds for the S&P 500 constituents.

The addition and removal of companies from the S&P 500 index, as seen with recent changes like Disney, Morgan, and Caterpillar, highlight the dynamic nature of the market. These adjustments reflect broader economic shifts, technological advancements, and changes in consumer behavior. As you leverage the tool, you’ll gain insights into how such changes can impact your investment strategy.

- Emerging Sectors: Pay attention to emerging sectors and technologies. Companies leading in innovation, like those in biopharmaceuticals and renewable energy, are increasingly making their way into the S&P 500. FintechZoom’s analytics tools can help you track these trends over time.

- Market Trends: Understanding macroeconomic trends and their impact on different industries is vital. It provides detailed analysis on market trends, helping you to adjust your strategy according to shifts in consumer demand, regulatory changes, or global events.

- Risk Management: Diversification is key in managing investment risks. With FintechZoom, you can explore the weightings and industry diversification within the S&P 500 to better balance your portfolio.

Remember, the ability to adapt and respond to changes in the market is what differentiates successful investors. With FintechZoom, you have a partner who equips you with the insights needed to navigate the complexities of the S&P 500, empowering you to make informed decisions for the future.

Conclusion

Navigating the S&P 500’s evolving landscape requires more than just a casual glance at stock prices. With companies like Disney, Morgan, and Caterpillar reflecting broader economic and technological shifts, it’s clear that staying ahead means adapting your investment strategy. FintechZoom has emerged as a critical tool in this process offering deep insights into market trends and the impact of sector changes. As you look to the future remember the importance of diversification and the need to stay informed. With the right resources at your disposal you’re better equipped to make decisions that align with your financial goals. Embrace the change and let FintechZoom SP 500 guide you through the complexities of the stock market.

Frequently Asked Questions

Does Warren Buffett buy S&P 500?

Yes, Warren Buffett believes the S&P 500 is a great investment for almost everyone and includes it in Berkshire Hathaway’s portfolio through two S&P 500 index funds. He often recommends these investments.

What is the average return of the S&P 500 in the last 10 years?

The S&P 500 has had an average yearly return of 12.02% over the last 10 years, up to December 2023. This reflects its performance as a benchmark index for U.S. stock market health.

What is the cheapest S&P 500 index fund?

The Fidelity 500 Index Fund (FXAIX) stands out as the cheapest S&P 500 index fund, boasting an expense ratio of just 0.015%. It does not require a minimum initial investment, nor does it impose sales loads or trading fees.

Is it better to buy SPY or SPX?

Purchasing SPY options is around 10 times less expensive than buying SPX options, with the cost difference attributed to the nature of the SPDR S&P 500 ETF Trust exchange-traded fund (SPY). This makes SPY a more cost-effective choice for many investors.

What is the difference between SPX and SP500?

The SPX symbol refers to the S&P 500 index, which is a compilation of the 500 largest U.S. publicly traded companies by market cap. While direct investment in SPX isn’t possible, investors can gain exposure to its performance through ETFs or index funds designed to track the index.