As fintech reshapes the financial industry, its impact on the FTSE 100 index is unmissable. In this article, we zone in on the fintech firms that are driving change and growth within this key market barometer, focusing on the FTSE 100 Fintechzoom. Discover the crucial fintech trends, their influence on the FTSE 100, and what it means for investors and the broader economy, without unnecessary jargon or fluff.

Key Takeaways

- The FTSE 100 Index, which tracks the top 100 companies on the London Stock Exchange, is a key indicator of the UK’s most significant corporations’ performance, and fintech companies have established a substantial presence within it.

- Fintech companies in the FTSE 100, such as Revolut, Monzo, and PayPal, are influencing the financial industry by utilizing digital technologies to offer innovative services and create new market trends, despite facing challenges like regulatory compliance and cybersecurity.

- Investors have opportunities to engage with the FTSE 100 FintechZoom through various investment vehicles like ETFs and index funds, aiming for profitable gains by considering factors like innovation, market trends, and risk tolerance.

Navigating the Intersection of Finance and Technology: The FTSE 100 FintechZoom Landscape

The London Stock Exchange (LSE), has become a magnet for fintech companies aiming for public market entry. It’s a platform that offers extensive international capital and global visibility. Companies like Wise, PensionBee, and LendInvest have successfully launched their IPOs on the LSE, tapping into its strong ecosystem of over 220 tech and consumer internet companies. By going public on the LSE, these companies secure permanent capital to maintain independence and have the ability to raise further funds for expansion and acquisitions.

The UK is a global fintech hub, housing approximately 2,500 fintech firms that raised a significant investment of £3.2bn in 2020. Some key sectors within the UK fintech industry include:

- Payments

- Regtech

- Insurtech

- Wealthtech

- Lending platforms

These firms are diversifying, and London’s financial market is providing them with varied routes to market.

Understanding the FTSE 100 Index

The FTSE 100 Index is a barometer of the UK stock market. It is a share index of the top 100 companies listed on the LSE, based on market capitalization, reflecting the market value and size of the UK’s most significant corporations. The primary function of the FTSE 100 is to deliver a snapshot of the performance of the UK’s leading companies across various sectors.

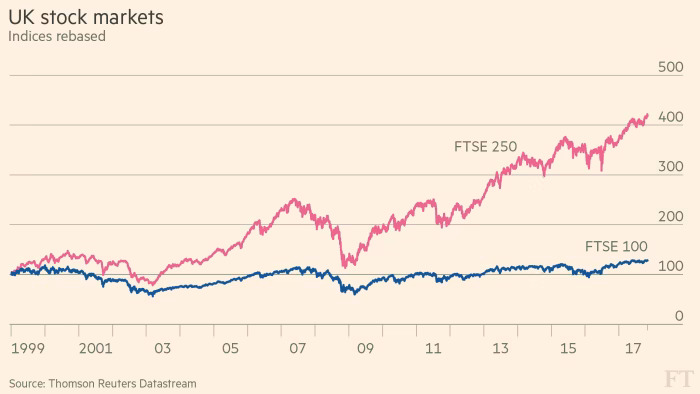

Much like the Nasdaq FintechZoom, Dow Jones Industrial Average and S&P 500 in the U.S., the FTSE 100 is closely watched by investors worldwide. It serves as a crucial barometer for the UK stock market, offering insights into the overall performance of the most capitalized companies in the UK.

The FintechZoom Influence on the FTSE 100

FintechZoom is a revolution reshaping the finance industry, and its influence is evident in the FTSE 100. As Ron Kalifa OBE, a leading figure in the sector, highlights, fintechzoom is a technological revolution that is reshaping the finance industry. Companies such as Revolut, Adyen, and Monzo, now part of the FTSE 100, reflect their significant role and impact on the market.

FTSE 100 fintechzoom companies have an international presence, driving innovation and competition across global markets. Their influence extends beyond the financial realm, affecting economic and social spheres, including job creation and investment.

Investment Strategies within the FTSE 100 Fintech Sector

The FTSE 100 index has had a 174.2% average return over the last 20 years.

Investing in the FTSE 100 Fintech sector involves thorough research and strategic decision-making. To maximize potential returns and minimize risks, investors must remain informed by staying updated with the latest financial news and analyzing market trends. With informed investment strategies, savvy investors stand a good chance to gain attractive returns within the FTSE 100 Fintech sector.

One essential step to maximize the benefits is to consult with a financial advisor. This ensures making informed decisions and capitalizing on the diverse investment opportunities in the fintech landscape by developing a solid investment strategy.

Trend Trading in Fintech Stocks

Trend trading in FTSE 100 fintechzoom stocks involves speculating on future price movements, and swing trading can be one of the strategies employed in trading stocks. Investors take long positions for expected price rises or short positions for anticipated declines. Contracts for Difference (CFDs) offer a way for investors to employ leverage and speculate on fintech stock price movements without owning the actual shares.

Investors often use indices as a comparative benchmark to evaluate how individual fintech stocks are performing relative to the broader fintech market within the FTSE 100.

Value Investing and Growth Potential

Value investing in the FTSE 100 Fintechzoom involves:

- Identifying undervalued companies that have the potential for long-term growth through fundamental analysis

- Finding companies that trade at prices below their intrinsic values

- Looking for companies with strong fundamentals, such as profitability, low debt, and positive cash flow.

Value investors can utilize stock market indices such as the FTSE 100 to focus on businesses with positive indicators of stable investment and potential for appreciation. For instance, International Personal Finance within the FTSE 100 fintech arena could be a target for value investors, as it demonstrates profitability and pays dividends, suggesting a stable investment with growth potential.

The Impact of Market Trends on Financial Transactions

Market trends significantly influence fintech companies’ dynamics. Constant changes driven by consumer behavior and technological advancements are reshaping the market. Consumer demand for digital financial solutions has driven the growth of fintechzoom companies in the FTSE 100, leading to a shift towards agile, user-centric banking experiences.

The fintech sector’s influence on economic and social spheres, including job creation and investment, is a direct result of prevalent market trends. Fintech companies satisfy consumer demands by providing easy-to-use innovative services through applications and platforms. They use consumer data to develop hyper-focused financial products catering to specific market segments, such as students and retirees.

The future of financial transactions in the fintechzoom arena is being shaped by digital currencies and the potential introduction of central bank digital currencies.

Real-Time Tracking of Stock Prices

Real-time tracking of stock prices offers investors a competitive edge in navigating unpredictable markets. It provides beneficial insights into potential opportunities and risks. Real-time tracking, when combined with powerful trading techniques, enables traders to take advantage of market opportunities and minimize risks by using the index as an effective trading tool. This approach allows for more informed and calculated trades..

There are two main types of tracker funds accessible to investors: Open-ended investment companies (OEICs) and Exchange-traded funds (ETFs). OEICs determine prices once per day while ETFs offer a ‘live’ price, providing more immediate knowledge of trade execution, catering to the need for real-time information. Tracker funds offer cost-effective investment options with average annual management fees ranging from 0.05% to 0.20%.

Tech Giants Disrupting Traditional Finance

Tech giants like PayPal and Square, now Block, have disrupted traditional financial institutions. They offer agile, user-friendly financial services and leverage their large customer bases and advanced technology platforms. Thanks to their user-friendly interfaces and modern security protocols, PayPal and Square remain at the forefront of the mobile payment industry.

Tech giants are enhancing financial inclusion by offering services like microloans and personal finance management tools to those typically underserved by traditional banking systems. The integration of tech-focused enterprises like PayPal and Square into the financial industry signifies a significant shift in economic power from traditional banking to these agile and innovative companies.

Risks and Rewards: The Fintech Sector’s Performance in the FTSE 100

The FTSE 100 Fintechzoom presents both risks and rewards. Fintech companies face challenges such as regulatory compliance and cybersecurity, but also demonstrate rapid growth and resilience. The financial performance among fintech companies varies, dependent on multiple influencing factors such as market trends and individual company strategies.

Despite the risks involved, the fintech sector within the FTSE 100 has experienced significant growth in recent years. This indicates robust health and a promising future, making the sector attractive for investments.

Balancing Risk with Innovation

It is important to understand the financial performance of Fintech companies in the FTSE 100 as it can help in making informed investment decisions. This understanding is crucial for investors seeking to make reasoned choices. The fintech sector is facing challenges and a changing regulatory landscape that impacts its operations.

The FTSE 100 fintechzoom is reviewed quarterly, ensuring it reflects the dynamic nature of the market and maintains relevance for investors. In response to increased regulatory attention, fintech companies focus on building sustainable, responsible, and compliant business models aimed at long-term profitability.

Fintech Companies’ Resilience and Growth

Fintech companies within the FTSE 100 have demonstrated rapid growth. Firms like Revolut achieved a revenue growth of 180% in 2020, underpinning their disruptive impact and increased customer acquisition rates. These firms also display inherent resilience with characteristics such as being cash generative and defensive, along with the ability to prosper in a high inflation environment.

Despite being loss-making, fintech startups like Funding Circle, with solid growth potential, present value investing opportunities for investors interested in the long-term growth trajectory within the FTSE 100 and the financial world.

The valuation of companies in the FTSE 100 fintechzoom is positively influenced by their commitment to sustainability and societal impact, reflecting the critical role of environmental, social, and governance (ESG) factors.

Staying Ahead in the Fintech Race: Key Players and Emerging Trends

The FTSE 100 Fintech sector is home to some of the UK’s biggest and most innovative financial companies. Key players influencing the sector include traditional institutions and payment service providers such as Barclays, HSBC, Mastercard, Visa, and PayPal, along with challenger banks and payment processing firms like Atom, SumUp, Monzo, Revolut, and Checkout.com.

Emerging trends in the FTSE 100 Fintechzoom include:

- The application of virtual and augmented reality for financial advice

- The creation of personalized robo-advisors

- The widespread adoption of digital currencies

These trends are set to further evolve the Fintech sector.

Who’s Who in FTSE 100 Fintechzoom

Key fintech companies such as:

- OakNorth Bank, which has secured significant equity investments totaling £637 million

- Zopa, which has secured significant equity investments totaling £657 million

- Starling Bank, which has secured significant equity investments totaling £715 million

indicate strong investor confidence. Additionally, digital banking platforms Monzo and Revolut, along with payment processing pioneers SumUp and Checkout.com, are noted for their substantial growth and investment interest.

Blockchain.com and Zepz have raised significant equity funding, amounting to £444 million and £528 million respectively, affirming their position on high-growth lists and their influence in the fintech industry. With over 1,600 firms, the UK fintech space presents select opportunities for value investing in the few publicly traded companies within the prestigious FTSE 100.

Predicting Future Trends – FintechZoom

Artificial Intelligence (AI) and machine learning are propelling advancements in trading algorithms and financial data analysis within the fintech industry. AI-driven technologies are instrumental in customizing financial guidance, enhancing fraud detection mechanisms, and powering intelligent customer service solutions such as chatbots.

Composer trade and EquBot are examples of platforms applying AI to enable sophisticated, AI-driven trading strategies and real-time financial market insights. The integration of AI, blockchain, and machine learning is set to shape the future of fintech, becoming standard technologies for creating innovative financial products and services.

Maximizing Profit: Leveraging FTSE 100 Fintechzoom for Investment Opportunities

Here is a table showing the FTSE 100 year by year. Please note that these values are subject to change and historical data may vary based on different sources. The values represent the FTSE 100 index at the end of each year:

| Year | FTSE 100 Index |

|---|---|

| 1984 | 1000.00 |

| 1985 | 1373.80 |

| 1986 | 1865.50 |

| 1987 | 1814.60 |

| 1988 | 1855.50 |

| 1989 | 2148.00 |

| 1990 | 2492.60 |

| 1991 | 2386.10 |

| 1992 | 2683.50 |

| 1993 | 3195.90 |

| 1994 | 3196.60 |

| 1995 | 3687.60 |

| 1996 | 3936.70 |

| 1997 | 5839.10 |

| 1998 | 5136.00 |

| 1999 | 6930.20 |

| 2000 | 6227.90 |

| 2001 | 5217.00 |

| 2002 | 3927.40 |

| 2003 | 4395.70 |

| 2004 | 4814.30 |

| 2005 | 5618.80 |

| 2006 | 6220.80 |

| 2007 | 6456.90 |

| 2008 | 4434.20 |

| 2009 | 5412.90 |

| 2010 | 5899.90 |

| 2011 | 5572.30 |

| 2012 | 5897.80 |

| 2013 | 6749.10 |

| 2014 | 6566.10 |

| 2015 | 6242.30 |

| 2016 | 7142.80 |

| 2017 | 7687.80 |

| 2018 | 6755.60 |

| 2019 | 7537.00 |

| 2020 | 6460.50 |

| 2021 | 7443.40 |

| 2022 | 7025.70 |

| 2023 | 7231.50 |

| 2024* | Data not yet available |

The table is provided by Fintechzoom.io for FTSE.

Investors can access the FTSE 100 Fintech market through various investment vehicles, including ETFs and index funds, to leverage investment opportunities. Exchange-traded funds like iShares Core FTSE 100 UCITS ETF and Vanguard FTSE 100 UCITS ETF provide investors with exposure to the FTSE 100’s constituents.

The FTSE 100 Fintechzoom boasts a range of innovative and disruptive companies that present various investment opportunities. When investing in this market, factors such as risk tolerance, diversification, and long-term growth prospects should be considered.

Sectors with Potential Opportunities

The UK fintech sector has collectively raised £26.8 billion in equity funding, with £6.48 billion secured in 2022 alone, signifying robust growth in the sector. Notable UK fintech unicorns like Revolut, Monzo, and Starling Bank have secured substantial investments, indicating high market confidence and opportunity within the sector.

Fintech enterprises such as Checkout.com, Zepz, and OakNorth Bank have attracted significant equity investments, demonstrating strong market potential and investor opportunities. FTSE 100 index tracker funds provide investors with a simplified avenue to invest in the largest UK companies, which often include key players from the fintech sector.

Strategies for Investing in FTSE 100 Fintechzoom

Tracker funds are a cost-effective strategy for investors looking to gain exposure to the FTSE 100 FintechZoom. They aim to replicate the performance of the index. Tracker funds are available as Open-ended investment companies (OEICs), which may track the entire index or a subset of it and have a once-a-day pricing system, or as Exchange-traded funds (ETFs) that track the index with a continuously updated ‘live’ price.

The average annual management fee for tracker funds is between 0.05% and 0.20%, exemplifying the cost-efficiency of this investment approach in the fintech sector. To achieve index performance replication, tracker funds either employ ‘full replication’ by investing in each company of the FTSE 100 index proportionally or use ‘partial replication’ to hold a representative sample of the companies.

Summary

The FTSE 100 Fintechzoom landscape is a dynamic intersection of finance and technology, with companies driving innovation and competition in the financial industry. Stay ahead of the industry by keeping up with market trends, making informed investment decisions, and consulting with financial advisors. Balance risk with innovation to maximize potential returns and mitigate risks. Keep an eye on key players and emerging trends, and leverage the FTSE 100 Fintechzoom for investment opportunities. The future of fintech is here, and it’s exciting!

Frequently Asked Questions

What is the FTSE 100 equivalent in the US?

The US equivalent of the FTSE 100 is the S&P 500, which consists of 500 leading stocks from various US exchanges.

What is an FTSE 100 company?

An FTSE 100 company refers to the Financial Times Stock Exchange 100 Index, which is an average of the share prices of the 100 largest and most actively traded companies on the London Stock Exchange (LSE). It represents the top 100 companies by market capitalization on the LSE.

What is the FTSE 100 Tech Business?

The FTSE 100 Tech Business refers to the technology companies listed on the London Stock Exchange’s “techMARK” market, representing innovative and tech-focused businesses.

What is the largest company on the FTSE 100 FintechZoom?

The largest company on the FTSE 100 is AstraZeneca, with a market capitalization of 173 billion British pounds.