The convergence of cryptocurrencies and financial technology is rapidly changing the financial landscape. This synergy has the potential to disrupt traditional financial institutions and reshape how we access, manage, and invest our money. Crypto Fintechzoom analyzes the convergence of two highly disruptive movements and decodes their combined impact on the financial industry. Cryptocurrencies like Bitcoin and Ethereum and financial technology innovations are modernizing legacy processes.

More specifically, Crypto Fintechzoom capitalizes on benefits in various areas, including:

- Decentralized Ledgers – Transparent and tamper-resistant record-keeping without centralized vulnerabilities

- Digital Currencies – Censorship-resistant peer-to-peer exchange mechanisms enabling individuals to transact freely without the need for intermediaries or oversight

- Smart Contracts – Self-executing agreements that automate transactions when certain conditions are met

- Consensus Protocols – Trust-building through cryptographic techniques and consensus algorithms to validate transactions and secure the network

- Tokenization – Digital representation of assets in diverse forms and ownership structures, allowing for fractional ownership, increased liquidity, and broader access to investment opportunities

Popular Cryptocurrency Market Constituents

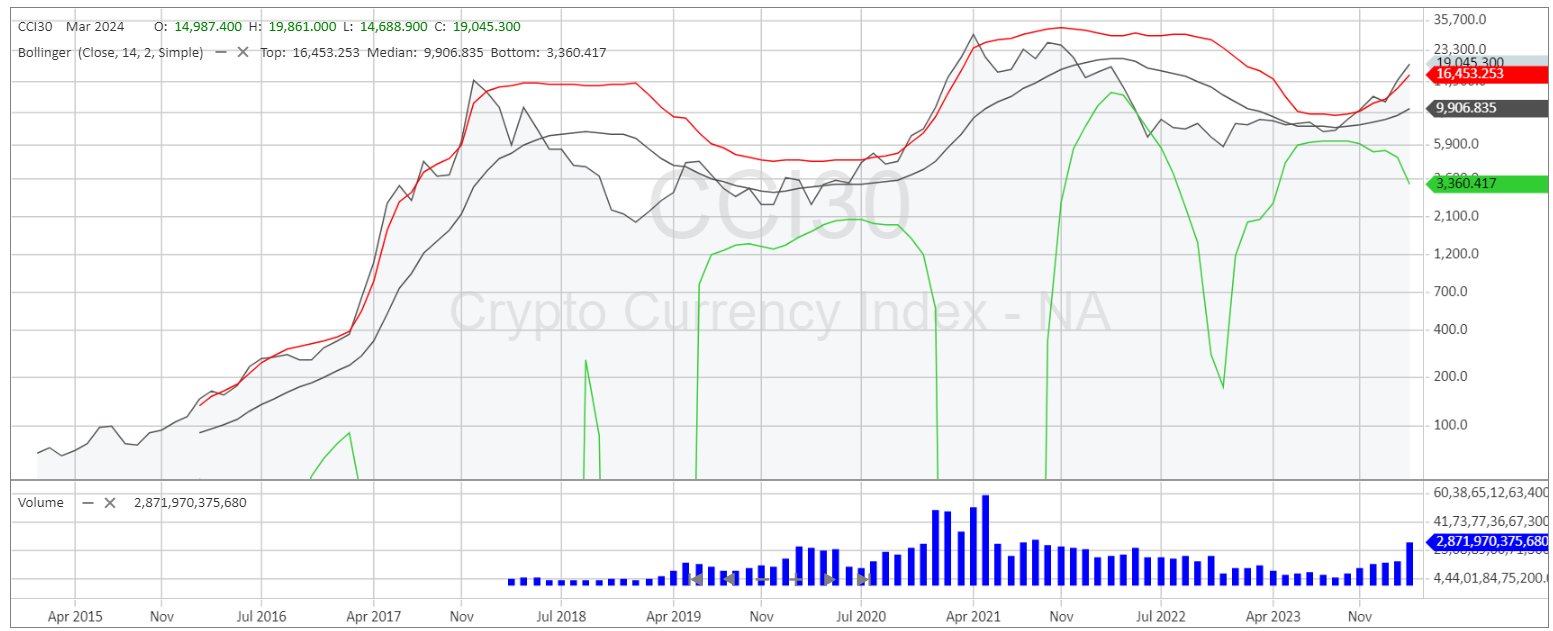

The popular cryptocurrency market constituents are the top 30 cryptocurrencies by adjusted market capitalization, as listed in the CCi30 index.

| Rank | Name | Symbol | Market Cap | Market Share | Price (USD) |

| 1 | Bitcoin (BTC) | BTC | $1,323,264,503,883 | 52.07% | $67,262.95 |

| 2 | Ethereum (ETH) | ETH | $405,122,293,851 | 15.94% | $3,374.10 |

| 3 | Tether USDt (USDT) | USDT | $106,149,148,229 | 4.18% | $0.9999 |

| 4 | BNB (BNB) | BNB | $88,369,302,203 | 3.48% | $590.96 |

| 5 | Solana (SOL) | SOL | $84,137,717,209 | 3.31% | $189.15 |

| 6 | XRP (XRP) | XRP | $33,616,344,232 | 1.32% | $0.6118 |

| 7 | USDC (USDC) | USDC | $32,885,415,511 | 1.29% | $0.9999 |

| 8 | Dogecoin (DOGE) | DOGE | $26,894,926,510 | 1.06% | $0.1871 |

| 9 | Cardano (ADA) | ADA | $21,002,821,495 | 0.83% | $0.5900 |

| 10 | Avalanche (AVAX) | AVAX | $18,009,613,821 | 0.71% | $47.68 |

| 11 | Toncoin (TON) | TON | $17,811,561,621 | 0.70% | $5.1323 |

| 12 | Shiba Inu (SHIB) | SHIB | $16,201,367,636 | 0.64% | $0.000027 |

| 13 | Bitcoin Cash (BCH) | BCH | $12,865,083,251 | 0.51% | $653.46 |

| 14 | Polkadot (DOT) | DOT | $12,327,544,276 | 0.49% | $8.6230 |

| 15 | Chainlink (LINK) | LINK | $10,609,631,103 | 0.42% | $18.07 |

| 16 | TRON (TRX) | TRX | $10,396,214,758 | 0.41% | $0.1185 |

| 17 | Polygon (MATIC) | MATIC | $9,007,730,869 | 0.35% | $0.9097 |

| 18 | Internet Computer (ICP) | ICP | $8,312,268,507 | 0.33% | $18.01 |

| 19 | Litecoin (LTC) | LTC | $7,545,145,445 | 0.30% | $101.43 |

The index is calculated using an exponentially weighted moving average of the market capitalization to smooth out volatility and provide a more accurate portrait of the market. The number of constituents in the index is set at 30 to capture a high percentage of the cryptocurrency market capitalization while maintaining statistical significance and diversification. The CCi30 index excludes stablecoins, which are pegged to a fiat currency.

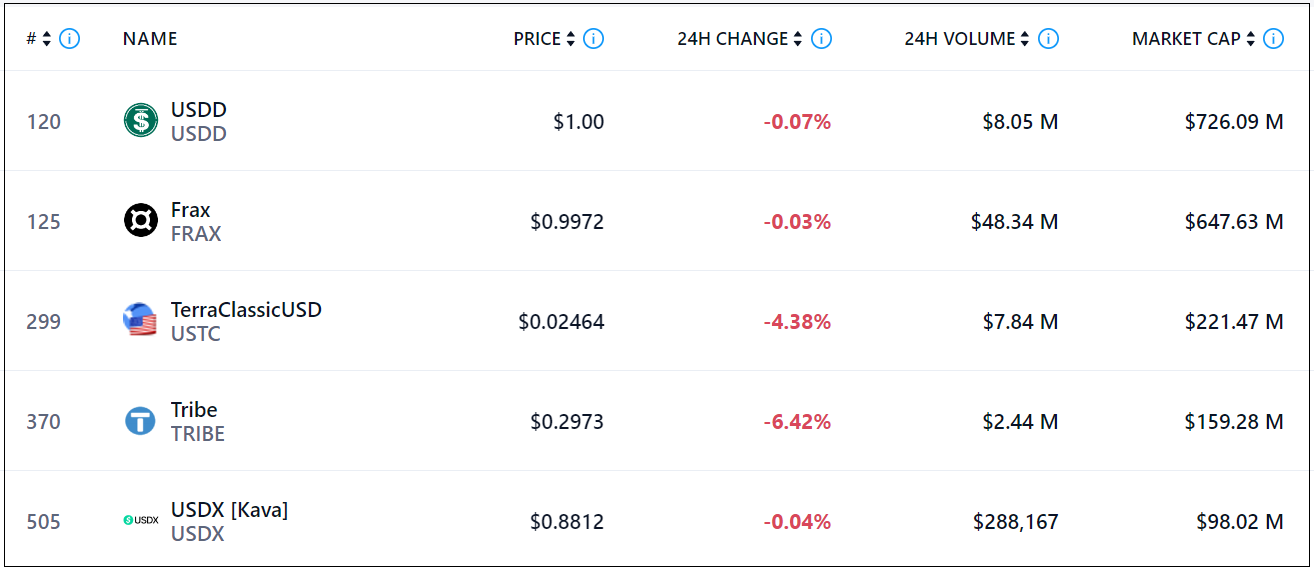

Algorithmic Stablecoins Tokens

Algorithmic stablecoins represent a new approach to maintaining price stability in the cryptocurrency market, relying on mathematical algorithms and on-chain mechanisms to manage supply and demand dynamics.

The Powerful Impacts of Crypto Fintechzoom

Cryptocurrency, with its innovative technologies and disruptive capabilities, has been instrumental in reshaping various aspects of the financial landscape. Here are some of the powerful impacts that the economic world is seeing:

- Financial Inclusion: By leveraging decentralized ledgers and digital currencies, crypto has opened up financial services to underserved populations worldwide. Individuals who were previously excluded from traditional banking systems now have access to secure and efficient financial transactions.

- Efficiency and Transparency: The use of smart contracts in cryptography has revolutionized the way agreements are executed. These automated if/then instructions not only streamline processes but also enhance transparency by ensuring that terms are enforced without the need for intermediaries.

- Trust and Security: Consensus protocols in Crypto Fintechzoom have established a new level of trust between counterparties. By eliminating the need for intermediaries and relying on mathematical algorithms for verification, transactions are secure, efficient, and resistant to manipulation.

- Asset Tokenization: Through tokenization, cryptocurrency has enabled the digital representation of assets in various forms and ownership structures. This has facilitated fractional ownership, increased liquidity, and expanded investment opportunities across different asset classes.

- Innovative Applications: The powerful impacts of Crypto Fintechzoom extend beyond finance. The technology has paved the way for the development of decentralized applications (DApps) and new business models that leverage the capabilities of blockchain and smart contracts.

Cryptocurrency Market Overview

The cryptocurrency market is a rapidly growing industry, with a market size of USD 1,330.43 billion in the current year. These digital currencies are increasingly being used in various end-use segments, including trading, e-commerce and retail, peer-to-peer payment, and remittance. The market is expected to continue its growth trajectory, driven by the rise of distributed ledger technology, increasing digital investments in venture capital, and a surge in demand across all regions. Crypto Fintechzoom identifies opportunities for innovative financial services tailored to the globalized digital economy.

The trading segment is the primary end-use category that holds the majority of the share in the Cryptocurrency Market. The market is segmented based on the market capitalization of various cryptocurrencies, including Bitcoin, Ether, Litecoin, Ripple, and Ether Classic.

- The market is expected to reach USD 1,902.5 million by 2028, exhibiting a CAGR of 11.1%.

- The hardware segment is expected to lead the market due to the increasing adoption of bitcoin.

Here is a table of top market players in the cryptocurrency realm:

| Category | Players | Description |

| Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Tether (USDT), BNB (BNB), Solana (SOL), XRP (XRP), USD Coin (USDC), Cardano (ADA) | These are the leading digital assets by market capitalization, each with its own unique features and purposes. |

| Crypto Exchanges | Coinbase, Binance, Gemini, Kraken, FTX | These platforms allow users to buy, sell, and trade cryptocurrencies. |

| Cryptocurrency Miners | Bitmain, Canaan AvalonMiner, Hivemind | These companies specialize in the hardware and process of mining new cryptocurrencies. |

| Crypto Wallets | MetaMask, Ledger, Trezor, Exodus | These digital wallets securely store users’ crypto holdings. |

| Blockchain Technology Companies | ConsenSys, Hyperledger, R3 | These companies develop and implement blockchain technology, the underlying infrastructure for cryptocurrencies. |

| Investment Firms | Grayscale Investments, Galaxy Digital Holdings, Digital Currency Group | These firms invest in cryptocurrencies and blockchain companies. |

| Regulatory Bodies | Securities and Exchange Commission (SEC) (US), Financial Conduct Authority (FCA) (UK) | These government agencies oversee and regulate the cryptocurrency market. |

How to Trade Cryptocurrencies?

Cryptocurrency trading involves speculating on the price movements of cryptocurrencies either through CFD trading accounts or by buying and selling the actual coins on exchanges.

Cryptocurrency trading can be done 24/7, and traders can take advantage of the market’s volatility to profit from rapid price movements.

According to Crypto FintechZoom, successful Crypto CFD Trading requires a combination of strategy, discipline, and risk management. Here are some tips to help traders achieve success in this market:

- Do not skip on understanding how crypto CFD trading works, including the mechanics of CFDs, cryptocurrency markets, and trading strategies in a hurry to trade. So, stay updated on market trends, news, and developments to make informed decisions.

- Set your trading goals, risk tolerance, and a well-defined strategy before entering trades. Also, determine entry and exit points, position sizes, and risk management rules guide in making trading decisions.

- Practice strict risk management by using stop-loss orders to control losses on trades and avoid over-leveraging.

It is a known fact that anyone trading always begins with a small trading account and gradually scales up as you gain experience and confidence. So avoid risking and start safe to earn big amounts of money at the same time.

Regulatory & Compliance Challenges for Crypto

Regulatory and compliance challenges for cryptocurrencies are significant and multifaceted, given the decentralized and borderless nature of digital assets. These challenges arise from the lack of clear guidelines and the rapidly evolving landscape of cryptocurrencies, making it difficult for governments and regulatory bodies to keep pace with the technology and its implications. Crypto FintechZoom highlights the potential for virtual currencies to address limitations within the traditional financial system.

One of the primary regulatory challenges for cryptocurrencies is their classification. Governments and regulatory bodies worldwide have struggled to classify cryptocurrencies as a currency, commodity, or security, leading to inconsistent regulations across jurisdictions.

For instance, in the United States, the Securities and Exchange Commission (SEC) has classified some cryptocurrencies as securities, while the Commodity Futures Trading Commission (CFTC) has classified others as commodities.

Another challenge is the lack of transparency and accountability in the cryptocurrency market. Due to the decentralized nature of cryptocurrencies, it is challenging to enforce anti-money laundering (AML) and know-your-customer (KYC) regulations, which are critical to preventing financial crimes such as money laundering and terrorist financing. The anonymity provided by some cryptocurrencies, such as Monero and Zcash, has further exacerbated these concerns.

Moreover, the cross-border nature of cryptocurrencies has created challenges for regulatory bodies to enforce regulations consistently. The lack of international cooperation and coordination has led to inconsistent regulations and enforcement across jurisdictions, creating confusion and uncertainty for cryptocurrency users and investors.

CryptoCurrency vs. Other Stock Market Indices

The cryptocurrency market offers diversification options for investors due to its low level of connectedness with traditional asset classes. Crypto prices can fluctuate dramatically in a single day, making them riskier but potentially offering higher returns. On the other hand, indices like the S&P 500 track a basket of established companies, leading to smoother price movements.

| Feature | Cryptocurrencies | Indices |

| Volatility | Highly Volatile | Less Volatile |

| Regulation | Less Regulated | Heavily Regulated |

| Accessibility | 24/7 Trading | Market Hours |

| Investment Horizon | Long-term or Short-term | Generally Long-term |

| Correlation | Less Correlated | More Correlated |

| Underlying Asset | Digital Asset | Basket of Companies |

Investment Analysis with Crypto FintechZoom

In 2024, the crypto market has maintained its bullish momentum, with bitcoin prices up 64.9% year-to-date and Ethereum prices up 55.6%. The market is experiencing a surge in demand for spot bitcoin ETFs, with 11 such funds approved in January 2024, giving investors their first opportunity to invest in funds that hold cryptocurrency directly.

Crypto FintechZoom champions a broader view. Don’t just rely on charts. Analyze news, social media sentiment, and global trends impacting crypto adoption.

The most promising cryptocurrencies for 2024 include:

- Bitcoin (BTC): With its largest market capitalization and growing institutional adoption, Bitcoin is a relatively safe haven in the volatile crypto market. It grew by 155% in 2023 and is poised to reach greater heights in 2024 due to the impending ETF approval, halving, and potential rate cuts from the US Fed.

- Ethereum (ETH): As the go-to platform for smart contracts and dApps, Ethereum fuels the burgeoning field of decentralized finance (DeFi). With the upcoming EIP-4844 proposal, which could reduce gas fees significantly on Layer 2 blockchains piggybacking on Ethereum, it is an excellent asset for holding.

- Solana (SOL): Solana boasts lightning-fast transaction speeds and low fees, attracting a thriving ecosystem of DeFi and NFT projects. Its continued focus on scalability and developer experience makes it a strong contender in the high-performance blockchain space.

- Filecoin (FIL): Filecoin is a decentralized peer-to-peer storage infrastructure gaining traction due to its connection with AI. Investors recognize its potential as a storage solution for vast datasets, making it a top-ranked altcoin worth investing in for long-term gains.

- Green Bitcoin (GBTC): Green Bitcoin is a newly launched cryptocurrency with a predict-to-earn ecosystem, providing users massive rewards through its gamified green staking mechanism. It offers a novel prediction market that allows users to stake their tokens to place forecasts on various events.

- Dogecoin20 (DOGE20): Dogecoin20 is an upgrade of Dogecoin, making it one of the hottest up-and-coming projects in the dog-based meme coin space today. Its staking ecosystem allows DOGE20 holders to stake their tokens and earn rewards, incentivizing long-term holding.

- Smog Token (SMOG): Smog Token is shaping up to be a promising cryptocurrency to invest in for long-term gains, with over 65,000 members across its social media platforms and over 29,000 token holders. It is a multi-chain, launching on Ethereum through Wormhole, allowing Ethereum holders to invest in the token.

These cryptocurrencies have been identified based on their market capitalization, real-world utility, innovative tokenomics, and clear regulatory frameworks, making them strong contenders for investment in 2024 and beyond.

Future Crypto Fintechzoom Trajectory

The cryptocurrency market is a dynamic landscape constantly evolving with new technologies and applications. By leveraging FintechZoom’s resources, we can identify some of the most significant trends shaping the crypto space:

- Bitcoin’s price movement: FintechZoom’s analysis can help us understand whether Bitcoin is currently in a bull market (prices rising) or a bear market (prices falling). This knowledge can inform investment decisions, with bull markets potentially attracting new investors seeking capital appreciation.

- Institutional adoption: Track the increasing involvement of institutional investors like hedge funds and corporations in the cryptocurrency market. This trend indicates growing mainstream acceptance and could lead to greater stability and price growth.

- The rise of Decentralized Finance (DeFi): Explore the booming DeFi sector with Crypto FintechZoom’s insights. DeFi offers financial services like lending and borrowing without traditional intermediaries. Understanding the potential of DeFi can help identify promising investment opportunities within this innovative space.

- The emergence of Non-Fungible Tokens (NFTs): Analyze the NFT market using FintechZoom’s tools. NFTs represent unique digital assets like artwork or collectibles. This trend highlights the potential for blockchain technology to revolutionize ownership and value creation in the digital realm.

Don’t just rely on technical indicators. Integrate news and sentiment analysis from Crypto FintechZoom to understand the factors driving market movements. Here’s how you can leverage its features:

- Market Demand: Analyzing the market demand for the cryptocurrency and its potential adoption.

- Tokenomics: Studying the token economics of the cryptocurrency to understand its supply and demand dynamics.

- Technology: Evaluating the underlying technology and innovation of the cryptocurrency.

- Regulatory Environment: Considering the regulatory landscape and legal implications affecting the cryptocurrency.

- Market Commentary and Expert Insights: Stay informed about industry developments and expert opinions through FintechZoom news articles, blog posts, or video content. Understanding broader market sentiment and expert analysis can provide valuable context for your investment decisions.

By combining Crypto FintechZoom’s resources with thorough due diligence on these factors, you can develop a comprehensive understanding of potential cryptocurrency investments and make informed choices based on your risk tolerance and investment goals.

FAQs

1. What are the most promising cryptocurrencies to invest in?

With its largest market capitalization and growing institutional adoption, Bitcoin (BTC) shows the most promising growth. It grew by 155% in 2023 and is poised to reach greater heights in 2024 due to the impending ETF approval, halving, and potential rate cuts from the US Fed. Potential investors are advised to carefully consider the risks associated with investing in cryptocurrencies before making investment decisions.

2. How are traditional financial institutions adopting cryptocurrency?

Traditional financial institutions see the decentralized nature of cryptocurrencies as both a risk and an opportunity. Financial institutions and banks are adopting crypto and blockchain technology for cross-border payment solutions. PayPal is now allowing cryptocurrency transactions on their network. The OCC (Office of the Comptroller of the Currency) has issued interpretive letters detailing how traditional financial institutions can enter into transactions involving cryptocurrencies and use public blockchains and stablecoins to process payments.

3. Can I trade Crypto CFDs on margin?

Trading on margin allows the traders to control larger positions with less capital. However, it results in increasing the risk of losses, therefore making it essential to use leverage carefully and manage risk effectively. The legality of Crypto CFD margin trading depends on your location. The US, for example, generally prohibits it.

4. How can investors’ attributes influence cryptocurrency pricing?

The cryptocurrency market, in particular, is characterized by substantial variability in beliefs over time and across investors. Younger individuals with lower incomes tend to be more optimistic about the future value of cryptocurrencies. Late investors, or those who invest later in the market cycle, also show more optimism. This variability in beliefs can lead to large price movements, including bubbles. Crypto FintechZoom suggests factoring in investor sentiment and demographics when making crypto investment decisions.