Gold has long been revered as a safe haven asset and a store of value, making it a focal point for investors seeking stability in uncertain times. Gold price FintechZoom is a financial technology platform that provides real-time data, insights, and analyses related to the gold market. Users can track live gold prices on FintechZoom, compare gold prices with other market indicators, and receive custom alerts about significant price changes

Investors can use live gold price charts to identify trends, support levels, and potential buying or selling opportunities based on market analysis and indicators

Gold Price FintechZoom Overview

As with many commodities, gold’s price is highly influenced by the forces of supply and demand. Yet this yellow metal is considered an investment asset. It is seen as a safegaurd against inflation and currency devaluation.

- Central banks hold gold to diversify their reserves, as it is a finite physical commodity that retains its value. Its desirability led to the gold standard, a monetary system where currencies were directly linked to gold.

- Gold prices are influenced by currency movements, particularly the U.S. dollar. A weaker dollar typically boosts gold prices.

- Gold can be bought as a bullion in its physical form or traded through gold futures or options contracts. Some investors choose to go with gold-mining stocks or gold-linked exchange-traded funds (ETFs) without actually holding the physical metal.

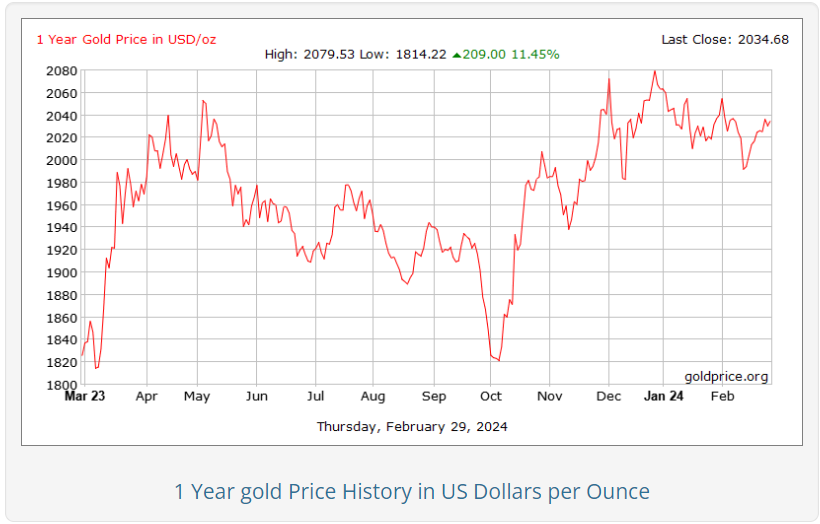

Gold Price Dynamics Over the Past Year

- Gold has decreased by 1.50% since the beginning of 2024, with a current price of around $2,030 per ounce.

- Overall for the past year, the price of gold has seen a positive change of over 10%.

- Gold reached an all-time high of $2150 in December 2023.

In 2022, as the Federal Reserve initiated rate hikes to combat inflation, gold prices experienced volatility and a downtrend before recovering in 2023 alongside moderating inflation expectations.

FintechZoom Gold Investment Strategies

Gold investments offer a balance between safety and potential returns. It is considered a safe-haven asset, meaning it maintains its value during economic downturns. At the same time, gold has the potential to appreciate in value, making it an attractive investment

It is essential to have attainable objectives when investing. you can do so by keeping an eye on gold price Fintechzoom for valuable insights. The platform revolutionizes gold investment strategies by offering a modern approach that provides investors with a fresh perspective and streamlined access to gold investments. Gold, despite its stability in the past, is not immune to market fluctuations. Therefore, knowing your level of comfort with risk and having a plan for when to get out will help you successfully navigate the often choppy waters of gold investment.

Gold may be tempting to invest in, but you need to have a plan before you buy. Spreading one’s investments among several types of assets might reduce exposure to market fluctuations. One further tactic is called “dollar-cost averaging,” and it entails investing a set amount at regular periods to even out the impact of market volatility.

What Moves Gold Price on Fintechzoom?

Key mechanisms that impact gold pricing include:

London Bullion Market Association (LBMA) Gold Price

The LBMA Gold Price serves as a central reference point for the physical gold market, established through an electronic auction held twice daily. This benchmark price is widely accepted globally for valuing significant gold transactions.

Key aspects of the LBMA Gold Price include:

- Electronic auction platform managed by ICE Benchmark Administration Limited

- Participants consist of banks and trading houses

- The auction is held twice daily

- Opening price set based on an equilibrium point where supply and demand bids balance out

- Widely accepted benchmark for valuing large gold transactions

Gold Futures Market

Gold futures contracts, traded on exchanges like COMEX in New York or the Multi Commodity Exchange (MCX) in India, play a crucial role in price discovery. Gold price Fintechzoom provides insights into future price expectations based on factors such as inflation, interest rates, and currency rates.

- It has a standard contract size of 100 troy ounces, with additional smaller contracts available.

- The trading times for gold futures are from 6:00 p.m. U.S. ET until 5:00 p.m. U.S. ET, Sunday through Friday.

Supply and Demand Dynamics

The fundamental principle of supply and demand drives gold prices. Mine production and recycled gold are significant sources of supply, while demand stems from sectors like jewelry making, investment, and central bank reserves. Imbalances between supply and demand exert pressure on gold prices.

- Gold’s use in jewelry and electronics impacts its demand

- Monetary policy and interest rates can influence gold prices through the concept of ‘opportunity cost,’ where higher interest rates make gold investments less appealing

- Employment figures, wages, and GDP growth can impact gold prices indirectly through the Federal Reserve’s monetary policy decisions

- Gold is priced internationally in US dollars, making currency fluctuations a critical factor influencing its price. A weaker dollar typically increases demand for gold as an alternative asset, while a stronger dollar can dampen demand and lower gold prices.

Gold Price FintechZoom vs. Traditional Gold Investment

FintechZoom has changed the way people trade in gold forever. The days of physically holding gold or traversing convoluted traditional investing channels are over, and now it’s all about ease of access and convenience. Investors may easily keep tabs on their holdings and the market’s performance with the help of FintechZoom’s safe and open platform.

Platforms like FintechZoom offer tools for comparing gold prices with other market indicators, currencies, or commodities, giving investors a broader perspective on the relationship between gold and various economic factors.

On FintechZoom, placing buy and sell orders is a breeze. Even people who are unfamiliar with the financial world will be able to confidently transact thanks to the platform’s user-friendly layout. First, potential investors sign up for an account on the site and are checked out for safety and legality. After getting on board, investors can choose from a wide range of gold investment vehicles, including actual gold and ETFs that track gold prices.

FintechZoom Features for the Gold Market

FintechZoom offers a comprehensive suite of features that cater to investors seeking real-time updates, historical trends, and in-depth analyses of the gold market. Here’s how FintechZoom empowers users with valuable insights:

- Real-Time Updates: It provides users with up-to-the-minute updates on gold prices, ensuring that investors have access to the latest market data to make informed decisions promptly.

- Investment Vehicles: FintechZoom platform offers a wide range of gold investment vehicles, including physical gold and ETFs that track gold prices. Investors can choose from various options to diversify their portfolios effectively

- Historical Trends: By offering historical data on gold prices, the software enables users to track and analyze past trends, identify patterns, and gain a deeper understanding of how gold prices have evolved over time.

- In-Depth Analyses: The platform goes beyond just providing raw data by offering in-depth analyses of the gold market. Users can access expert insights, market commentary, and trend analyses to help them interpret the data effectively.

- Market Indicator Comparison: Users can compare FintechZoom gold prices with various market indicators such as stock indices, currency exchange rates, or commodity prices. This comparative analysis helps traders understand the interplay between different asset classes and make more informed investment decisions.

- Performance Metrics: FintechZoom gold price chart provides performance metrics that allow users to assess how gold prices stack up against other assets over different time frames. This feature aids in evaluating the relative strength of gold as an investment option.

- Customizable Tools: The platform offers customizable tools for comparative analysis, allowing users to tailor their comparisons based on specific parameters or preferences. The personalized alerts feature keeps users updated on critical price movements and events that could impact their investments even when not actively monitoring the platform.

S&P 500 vs. Gold: Which is the Better Investment?

Recent Performance:

- Gold: Gold reached an all-time high of nearly $2150 in December 2023 and spiked above $2,000 per ounce during the Russia-Ukraine conflict in early 2022.

- S&P 500: The S&P 500 is up 7.6% in 2023.

One-Year Performance:

- Gold: The SPDR Gold Shares ETF (GLD) is up 8.6% so far in 2023.

- S&P 500: The S&P 500 is up 7.6% in 2023.

Five-Year Performance:

- Gold: From 1990 to 2020, the price of gold increased by around 360% as tracked by FintechZoom gold price charts. Over the same period, the Dow Jones Industrial Average (DJIA) gained 991%.

- S&P 500: The S&P 500 Index had a 10.43% average annual total return between 1970 and 2022.

Ten-Year Performance:

- Gold: For the last decade, gold prices rose by 55%.

- S&P 500: The S&P 500 Index had a strong performance over the long term, with an average annual total return of around 164% over the last 10 years.

While gold can outperform the S&P 500 for short periods, over extended periods like the last decade, the S&P 500 has significantly outperformed gold. Dow Jones Fintechzoom also shows promising trends in the 5-year range. Long-term investors are advised to consider this performance difference when making investment decisions and may choose to allocate a majority of their investments to index ETFs like the S&P 500 ETF Vanguard (VOO) rather than precious metals like gold.

Gold Price (5-year Forecast) by FintechZoom

| Year | Average Price | Year-End Price | High Price |

| 2024 | $2,017.05 | $2,073.05 | $2,084 |

| 2025 | $2,156 | $2,264 | $2,317 |

| 2026 | $2,395 | $2,481 | $2,705 |

| 2027 | $2,553 | $2,681 | $2,707 |

| 2028 | $2,553 | $2,681 | $2,707 |

Disclaimer: This table is based on the analyst’s opinion and should not be considered financial advice. Please remember that past performance is not indicative of future results.

Interested in Nasdaq index? Check out FintechZoom Nasdaq charts.

Conclusion

The price of gold remains a pivotal indicator in the Fintechzoom landscape, reflecting global economic conditions, investor sentiment, and geopolitical tensions. Gold is often viewed as a diversifying investment that can add stability to a portfolio. It is considered a safety net during economic uncertainties and a potential hedge against inflation. Investors should carefully assess their individual circumstances, risk tolerance, and market outlook before deciding to invest in gold. Keeping an eye on gold price Fintechzoom can provide valuable insights for investors seeking to make informed decisions in the market.

Frequently Asked Questions

Is gold sensitive to interest rates?

Gold is indeed sensitive to interest rates, with its price influenced by various factors including inflation, market sentiment, supply and demand dynamics, and real yields. Historically, there has been a belief that rising interest rates make fixed-income investments more attractive, leading to a potential outflow of funds from gold into interest-bearing securities. However, the relationship between gold prices and interest rates is not always straightforward. While some argue that higher interest rates could weaken gold prices due to increased competition from other investments, historical data shows mixed correlations between interest rates and gold prices.

Where does gold fit into a portfolio?

Gold can play a significant role in a diversified investment portfolio due to its unique characteristics and benefits. It has a low correlation with other asset classes like stocks and bonds. Its ability to act as a “store of value” can help mitigate risk during market volatility and economic uncertainty. It can even serve as a risk-management tool. Experts suggest allocating around 10-15% of a diversified portfolio to gold and gold-related equities.

What will the gold price be in 5 years?

Many market analysts see gold rising to $2,289 by May 2028, with a projected price of $2,090 in one year’s time. These projections indicate a positive outlook for gold prices over the next 5 years, with experts foreseeing continued growth and potential peaks in the value of this precious metal. However, it is important to remember that these gold price forecasts are subject to change based on various economic and geographical factors.

How does Fintechzoom mitigate the risks associated with gold investment?

Users can leverage educational resources to understand the nuances of the gold market better. By providing valuable insights and information, gold price Fintechzoom equips investors with the tools needed to make informed investment decisions.